In a world of digital payments and financial apps, it might seem old-fashioned to use cash envelopes—but for many people, it’s one of the most effective ways to take control of spending.

The cash envelope system is simple, visual, and hands-on, which makes it especially helpful for beginners or anyone struggling to stick to a budget.

In this article, you’ll learn exactly how the cash envelope system works, why it’s so effective, and how to start using it today to improve your money habits.

What Is the Cash Envelope System?

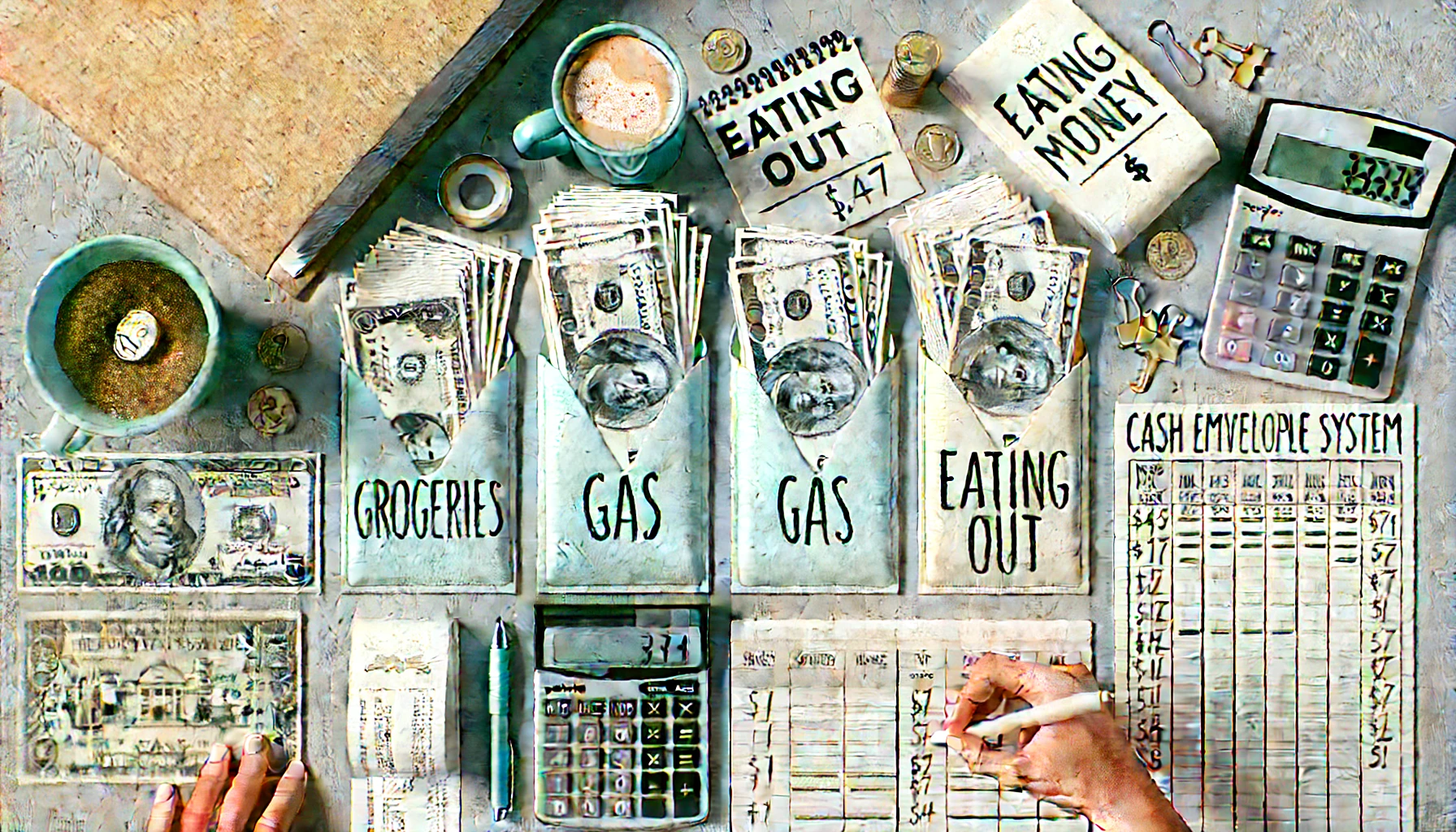

The cash envelope system is a budgeting method that uses physical cash and envelopes to manage your spending in specific categories.

Here’s how it works:

- You create a monthly (or weekly) budget.

- You divide cash into envelopes labeled by category (e.g., groceries, gas, fun).

- You only spend what’s in the envelope.

- When the envelope is empty—you stop spending in that category.

It brings a level of awareness and discipline that debit or credit cards can’t.

Why the Envelope System Works So Well

✅ It’s visual—so you always know how much you have left.

✅ It’s physical—you feel every dollar you spend.

✅ It enforces limits—you literally can’t overspend.

✅ It builds good habits and reduces impulsive buying.

✅ It doesn’t require apps or internet access.

Even if you eventually switch to digital tools, many people find starting with cash is the key to getting their spending under control.

Who Should Use This System?

The cash envelope system is perfect if:

- You often overspend without realizing

- You want to feel more connected to your money

- You’ve tried apps but didn’t stick with them

- You’re on a fixed income or trying to pay off debt

- You want to reset your relationship with spending

Step 1: Create Your Budget and Categories

Before filling envelopes, you need to know how much money you have and where it should go.

Start with your monthly or weekly take-home income.

Then list your spending categories. Focus on variable expenses—the ones that change and are easiest to overspend on.

Common envelope categories:

- Groceries

- Gas or transportation

- Eating out

- Entertainment

- Personal care

- Household items

- Miscellaneous or “fun money”

Don’t include fixed expenses like rent or utilities—those are usually paid digitally.

Step 2: Decide How Much Cash to Put in Each Envelope

Look at your budget and decide how much cash each category gets.

Example for a weekly budget:

- Groceries: $100

- Gas: $40

- Eating out: $25

- Fun: $20

- Household: $15

Total cash needed: $200

This money comes straight from your paycheck, and it’s withdrawn at the start of the week or month.

Step 3: Prepare Your Envelopes

You can use:

- Actual paper envelopes

- Plastic zipper pouches

- A wallet with labeled dividers

- Printable templates or pre-made cash envelope systems (found online)

Label each envelope clearly. You can even color-code them to make things more visual.

Step 4: Spend Only from the Envelopes

Whenever you make a purchase:

- Take the money from the appropriate envelope

- Keep receipts if you want to track details

- When the cash runs out, that’s it—no more spending in that category

This forces you to think before you buy—and helps you avoid impulse spending.

Step 5: Refill and Review

At the end of the week or month:

- Review how much you spent

- Adjust if needed for next month

- Refill envelopes with the next budget cycle

- Celebrate if you stayed under budget in any category!

Some people roll leftover money into savings or a reward category.

What If You Need to Spend Online?

You can still use the cash envelope method with digital payments:

Options:

- Use “digital envelopes” through apps like Goodbudget or Mvelopes

- Keep track on paper or a spreadsheet

- Deduct from the envelope as if you spent the cash

- Keep the physical cash in a drawer and adjust after online purchases

The goal is still the same: limit your spending by category.

Tips for Success

- Start with just 3–5 categories to keep it simple

- Be realistic—don’t underfund essential categories

- Keep envelopes in a safe but accessible place

- Carry only what you need daily

- Use a tracking sheet to record envelope activity if you like extra detail

This method trains your brain to stay within limits—and builds discipline.

Final Thought: Real Money, Real Awareness

The cash envelope system isn’t about going backward—it’s about going back to basics. It reconnects you with your money in a tangible, powerful way.

If you’ve been feeling out of control with spending, try this method for just one month. You may be surprised how much more mindful, confident, and in control you feel.

Sometimes, the best financial tools don’t need Wi-Fi—just a few envelopes and a plan.