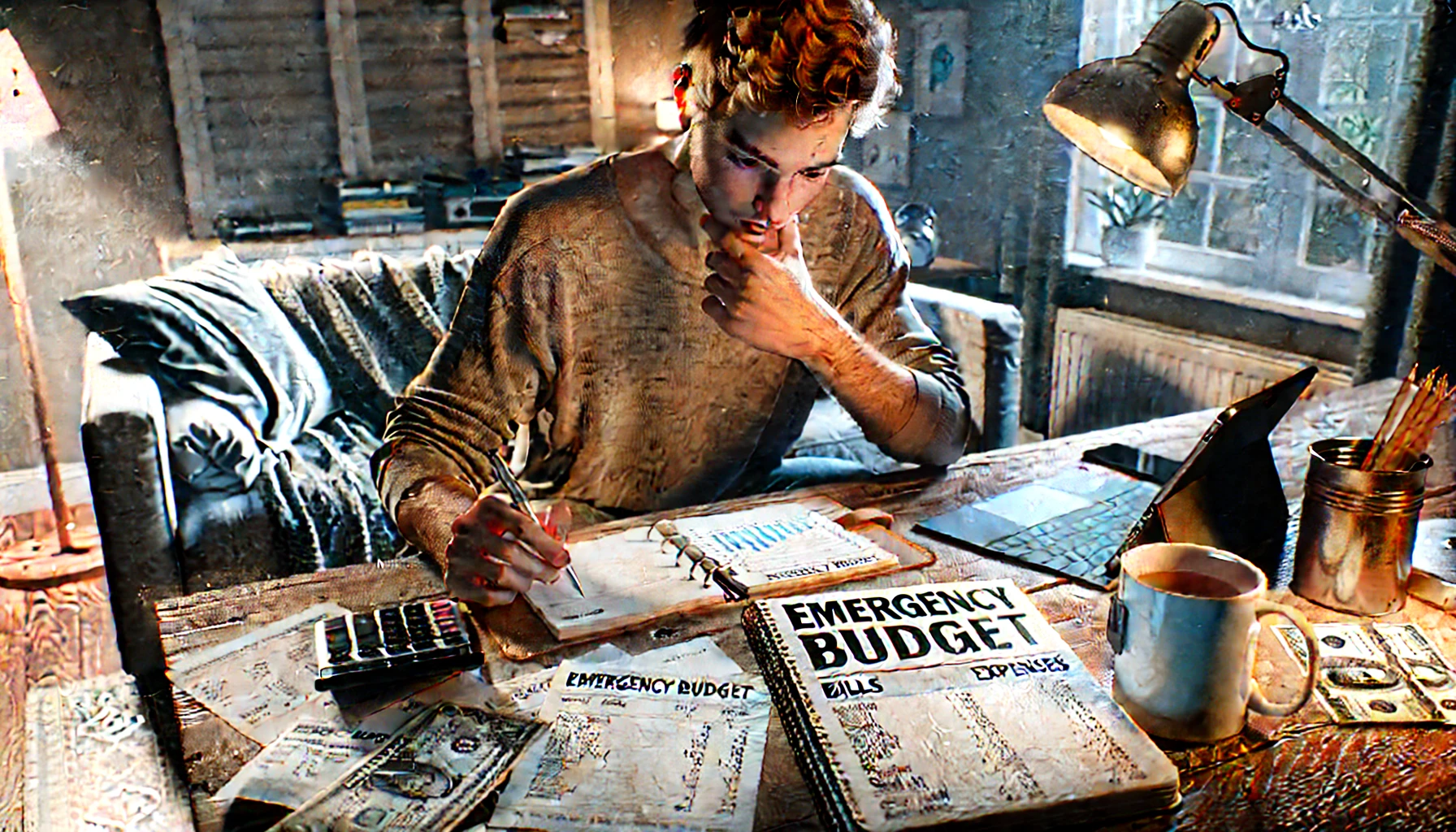

Sometimes life throws you a curveball—unexpected job loss, reduced income, surprise bills. And when that happens, the usual budget might not cut it.

That’s when you need an emergency budget.

An emergency budget is a temporary financial plan that helps you stay afloat, avoid debt, and prioritize what really matters—until things stabilize.

In this article, you’ll learn how to quickly create and use an emergency budget, so you can take back control even in uncertain times.

Step 1: Know Exactly What You’re Working With

Start by identifying your current, reliable income:

- Paychecks (even reduced ones)

- Government assistance or benefits

- Side hustle or freelance income

- Support from family (if applicable)

This is your real number for the month. Don’t plan based on what you hope to make—use what’s actually coming in.

Step 2: List All Your Essential Expenses

These are the non-negotiables. What do you truly need to survive and work?

Common essentials:

- Rent or mortgage

- Utilities (electricity, water, internet)

- Basic groceries

- Transportation (fuel, bus pass, car insurance)

- Minimum payments on debt

- Phone bill (especially if you need it for work or job searching)

Be brutally honest—this isn’t the time for “nice to haves.”

Step 3: Cut or Pause Non-Essentials

Now look at where you can cut back—at least temporarily.

Categories to reduce, pause, or eliminate:

- Subscriptions (streaming, apps, gym)

- Dining out and delivery

- Online shopping or clothing

- Entertainment expenses

- Extra data plans or services

This is temporary. You’re not giving things up forever—you’re buying breathing room.

Step 4: Set Priorities with the Money You Have

Once you know your essentials and your income, create a plan.

Example:

- Income: $1,800

- Rent: $800

- Groceries: $300

- Utilities: $150

- Transportation: $100

- Debt minimums: $200

- Phone: $50

- Emergency buffer: $100

- Total: $1,700

- Leftover: $100

Every dollar should have a purpose—there’s no room for guesswork in an emergency budget.

Step 5: Stop Using Credit (Unless It’s the Last Resort)

It’s tempting to lean on credit cards when money is tight, but this can create long-term problems.

Only use credit if:

- It’s for a true emergency

- You have a realistic way to pay it back quickly

- It’s part of a strategic plan, not a habit

If possible, focus on staying current with minimum payments and avoiding new debt.

Step 6: Look for Temporary Income Boosts

Even small boosts can make a big difference in an emergency.

Ideas:

- Sell unused items online

- Offer quick local services (babysitting, cleaning, tutoring)

- Use gig apps (delivery, pet sitting, rideshare)

- Ask for temporary freelance work in your network

Remember: you’re not trying to “get rich”—you’re trying to get stable.

Step 7: Reevaluate Weekly and Adjust

Situations change fast in a crisis. Review your emergency budget every week.

Ask:

- Has anything changed with income or bills?

- Can I shift any leftover funds toward savings?

- Is there anything else I can cut or adjust?

Stay flexible and give yourself grace—it’s not about perfection, it’s about resilience.

Step 8: Make a Plan to Rebuild Later

Once things stabilize:

- Rebuild your emergency fund

- Reintroduce non-essentials gradually

- Shift from survival mode back to growth mode

- Celebrate how you got through it

Your emergency budget helped you protect what matters most—and now you’re ready to rebuild stronger than before.

Final Thought: When Life Gets Tough, So Can You

A tight month (or few) doesn’t mean you’ve failed.

It means you’re adapting, thinking smart, and taking control of what you can.

Your emergency budget is proof of your strength—not your limits.

Use it with intention. And remember: this season won’t last forever—but the skills you build now will.